SLC Agrícola

OPERATING EFFICIENCY

The company introduced modern management techniques derived from the industrial sector, bringing competitive advantages that support SLC Agrícola’s position in global agriculture.

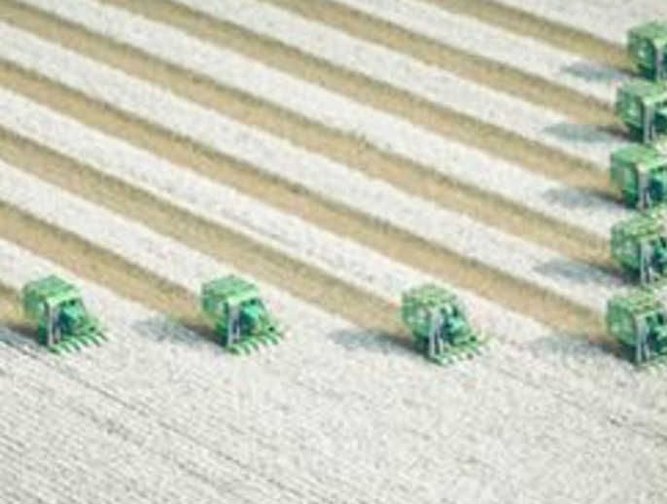

High productivity: Based on data from Conab and USDA, the company production of cotton and soybeans is higher than domestic and US averages. Such results are due to:

- a cost structure and efficient operating cycle,

- production technology, with high mechanization of the planting and harvesting process;

- use of crop rotation system,

- mastery of the direct planting technique,

- and experience in correcting the chemical composition of soil and in selecting seeds.

Moreover, SLC Agrícola expects that the introduction of genetically modified seeds will increase productivity and reduce production costs--particularly of pesticides.

Strategic and diversified location: SLC Agrícola’s portfolio of assets is diversified, with its fourteen farms strategically located in six states of the Cerrado[1]: Goiás, Mato Grosso, Maranhão, Mato Grosso do Sul, Bahia and Piauí. This type of localization reduces potential regional climate risks and the incidence of pests and diseases.

Scale and Standardization: The company business model is based on the standardization of production on its several farms. This entails adapting physical facilities, productive infrastructure, equipment, an operating organizational chart, standardized administrative management and agricultural planning.

Crop Rotation

In addition to providing several benefits to the production process, the crop rotation system used on all of SLC Agrícola farms ensures reduction of fixed costs. The greater control over weeds, lower incidence of pests and diseases, and better use of machines and employees are only some of the productive benefits gained.

Those crops also represent significant synergies, since the fertilizer leftover from one crop is reused on the next. Furthermore, pests and diseases are more easily controlled by means of the natural rotation.

Soil Management

SLC Agrícola uses direct planting to reduce the loss of soil, water and nutrients to negligible levels. Production costs are reduced with direct planting by decreasing the operation of machines and preserving soil and nutrients. This reduces the need for heavy fertilization. Additionally, there is an increase in the productive potential of crops.

RESEARCH AND TECHNOLOGY

The information obtained from research conducted in the company and official research authorities is used to plan crops.

Each of the 14 farms has a research unit. Among the most explored topics are:

- fertilization and soil management systems

- competition of other soybean growers,

- cotton and corn hybrids,

- planting seasons,

- and assessment tests on the efficiency of fungicides, insecticides and herbicides.

Those experiments simulate the actual conditions of crops and are conducted according to scientific criteria. 190 tests are conducted at SLC Agrícola every year. The area used to conduct the experiments is nearly 1,300 hectares.

GROWTH STRATEGIES

The company expansion strategy is to purchase new farms, enlarge the cultivation of the second crop and expand production via lease.

By using a market analysis that accounts for size, soil quality, location, climate, altitude, topography, price per hectare, logistic development potential and documentation standards, SLC Agrícola will identify and purchase properties in the Brazilian Cerrado with high production potential and market price appreciation.

As for cultivation, favorable climate and mastery of technology makes the planting and harvesting of the second crop of cotton and corn favorable in the same crop year. This allows for enlarging the planting area, reducing the cost of the produced unit, and crop management technical benefits.

The leasing of areas close to already established farms aims to enlarge the plantation area. This will make it possible to increase production by using the existing structure and to reduce fixed and production unit costs. Finally, it will lower demand for initial investment.